Board of Directors Report

The route optimization and operational efficiency strategy implemented by AirAsia has proven successful in making a positive contribution to performance growth throughout 2024. This strategy also improved on-time performance (OTP) to 83%, an increase from 73% in 2023, which in turn had a positive impact on revenue growth in 2024.

Dear Shareholders and Stakeholders,

We express our praise and gratitude to God Almighty for His blessings and grace, enabling PT AirAsia Indonesia Tbk to achieve better performance compared to the previous year. Amidst uncertain conditions, AirAsia successfully leveraged the momentum of the aviation industry’s post-pandemic recovery, optimizing opportunities for growth.

This recovery momentum also supported the Company’s strategy in opening new flight routes and strengthening collaborations with stakeholders in the tourism sector, both domestically and internationally. These efforts represent key strategic steps in maintaining the Company’s position amid the increasingly competitive aviation industry.

On this occasion, allow us to present the performance report of PT AirAsia Indonesia Tbk for the 2024 fiscal year. This report covers the implementation of business strategies and performance achievements throughout the year, challenges faced, corporate governance practices, and the Company’s business prospects. The Annual Report and Sustainability Report is prepared as a form of transparency in all business activities undertaken, as well as the Company’s accountability to shareholders and all stakeholders.

2024 Economic and Industry Outlook

Global Economic Conditions

Throughout 2024, the global economy remained fraught with uncertainty. Ongoing geopolitical tensions in Europe and the Middle East, along with the trade war between the United States and China, posed significant challenges, leading to disruptions in global supply chains, price volatility, and persistently high inflation rates, ultimately causing a decline in international trade.

According to the World Economic Outlook Update released by the International Monetary Fund (IMF) in January 2025, global economic growth was projected at 3.2% for 2024, slightly lower than the 3.3% recorded in 2023. Advanced economies experienced stagnation, maintaining a growth rate of 1.7%, unchanged from 2023, while emerging markets were expected to grow by only 4.2% in 2024, slightly decreased from 4.4% in the previous year. This overall decline was primarily driven by economic pressures in several Asian and European countries.

Despite economic uncertainties, the aviation industry demonstrated a positive growth trend, although it had not yet fully recovered. The International Air Transport Association (IATA) reported that global air travel demand continued to rise, with passenger capacity projected to grow by 7.5% throughout 2024. However, the industry still faced challenges, including delays in new aircraft deliveries due to supply chain disruptions from major manufacturers and rising operational costs that affected airline profit margins.

Revenue Passenger Kilometers (RPK), which was the total number of paying passengers multiplied by the total distance flown across all routes, increased by 10.4%, while Available Seat Kilometers (ASK), the total number of seats available multiplied by the total flight distance for all routes, rose by 8.7% year-on-year. This growth reflects the rising demand for air travel and the aviation sector’s strengthening recovery.

Although the industry continues to face various challenges, optimism for its growth remains strong. Air travel demand continues to rise, supported by declining jet fuel prices and expanding tourism worldwide. The Asia-Pacific region recorded significant passenger traffic growth, driven by increasing mobility among travelers. With these developments, the global aviation industry is expected to continue its sustainable growth trajectory, albeit with the need to adapt to ever-changing external dynamics.

Global Aviation Industry Growth in 2024

| Description | Share | Year on Year (%) | ||

|---|---|---|---|---|

| RPK Growth | ASK Growth | PLF Growth | ||

| Africa | 2.2% | 13.2% | 9.9% | 2.2% |

| Asia Pacific | 33.5% | 16.9% | 12.3% | 3.2% |

| Europe | 26.7% | 8.7% | 8.1% | 0.5% |

| Latin America | 5.3% | 7.8% | 7.1% | 0.6% |

| Middle East | 9.4% | 9.5% | 8.4% | 0.8% |

| North America | 22.9% | 4.6% | 4.6% | 0.0% |

| Total | 100.0% | 10.4% | 8.7% | 1.3% |

Source: IATA, 2024

Indonesia’s Economic Conditions

Indonesia’s economy in 2024 demonstrated strong resilience amid global uncertainties, maintaining a relatively high growth rate despite external challenges. According to data from the Statistics Indonesia (BPS), the national economy grew by 5.03%, slightly lower than the 5.05% recorded in the previous year. The country’s Gross Domestic Product (GDP) at current prices reached Rp22,139.0 trillion, with GDP per capita amounting to Rp78.6 million or USD4,960.3. Household consumption remained the primary driver of economic growth, contributing 54.04% to GDP.

From a sectoral perspective, the highest growth was recorded in other services (9.80%), followed by transportation and warehousing (8.69%), and accommodation and food and beverages (8.56%). The growth in the transportation sector reflects increased public mobility, while the hospitality and food and beverage sectors continued to expand in line with the recovery of the tourism industry.

The aviation industry’s recovery continued to gain momentum. Domestic passenger numbers reached 63.7 million, an increase of 1.76% compared to 2023, while international passenger numbers grew by 21.46% to 19.0 million. This increase aligned with rising mobility and various government policies supporting the aviation industry, including incentives for airlines and the optimization of airport infrastructure.

Data from BPS also showed that the number of domestic tourist trips reached 1.02 billion, marking a 21.61% increase from 2023. Meanwhile, the number of international tourist arrivals in Indonesia rose by 19.05% to 13.90 million.

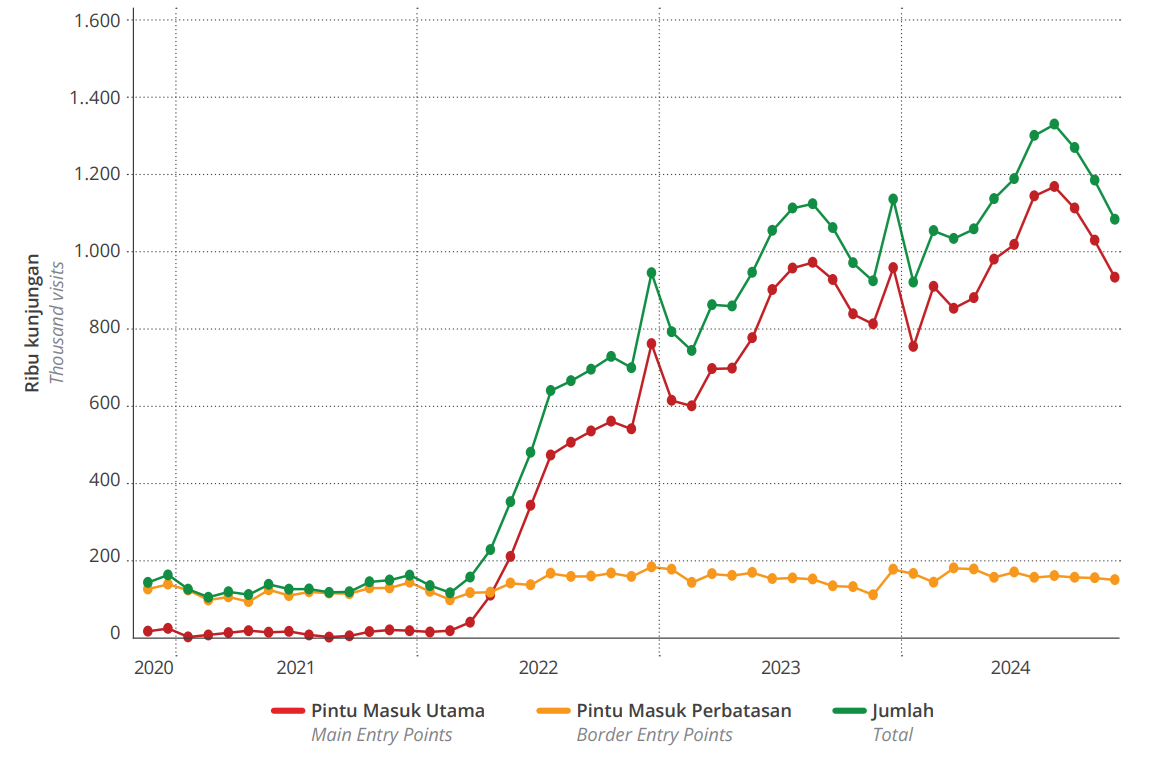

Development of the Number of International Tourist Trips 2020 - 2024 (Thousand Trips)

From the total international tourist arrivals, 76.94% entered via air travel, with Ngurah Rai and Soekarno-Hatta Airports serving as the two main entry points, contributing 90.74% of all inbound international tourists. Domestic passenger departures also showed growth, reflecting the strong demand for air transportation.

Amid these developments, the Company continued to adjust its business strategies to remain competitive in the growing air travel market. The Company recorded an On-Time Performance (OTP) rate of 83%, an improvement from 73% in the previous year. Additionally, revenue increased by 15% compared to 2023.

With a solid economic foundation and sustained growth in the tourism and transportation sectors, the national aviation industry is projected to continue expanding in the coming years. AirAsia remains committed to adapting to industry dynamics and maximizing available growth opportunities.

Strategy and Implementation of Strategic Policies in 2024

AirAsia continued to strengthen its position in the aviation industry by implementing various strategic policies aligned with market dynamics and customer needs. In response to economic conditions and industry developments, AirAsia adopted several key strategies, covering pricing, route management, marketing, distribution, and ancillary service development.

The pricing strategy was formulated by considering consumer purchasing power and regulations on the Upper Fare Limit (TBA) and Lower Fare Limit (TBB) to maintain a balance between competitiveness and profitability. Additionally, route optimization efforts were consistently carried out to enhance operational efficiency and ensure that selected flight routes had strong demand potential.

Throughout 2024, the Company also introduced new flight routes, both domestic and international, primarily focusing on leisure destinations. The newly launched domestic route was Denpasar (DPS) – Bandar Lampung (TKG). Meanwhile, the new international routes included Jakarta (CGK) – Kota Kinabalu (BKI), Jakarta (CGK) – Bandar Seri Begawan (BWN), Jakarta (CGK) – Hong Kong (HKG), Denpasar (DPS) – Phuket (HKT), Denpasar (DPS) – Kota Kinabalu (BKI), Denpasar (DPS) – Cairns (CNS), and Denpasar (DPS) – Hong Kong (HKG).

The Company also continued to strengthen partnerships with key stakeholders in the tourism sector, such as the Ministry of Tourism of the Republic of Indonesia. AirAsia also collaborated with international tourism boards, including the Singapore Tourism Board, Malaysia Tourism Promotion Board, Tourism Authority of Thailand, Brunei Tourism Board, Hong Kong Tourism Board, Western Australia Tourism, Tourism Tropical North Queensland, Tourism and Events Queensland, and the Australian Tourism Board. These partnerships ensure strong cooperation to support sustainable business growth amid the evolving aviation industry.

The Role of the Board of Directors in Strategy Formulation

The Board of Directors actively leads the formulation of the Company’s strategies and strategic policies. This involvement spans the entire process, from strategic direction, analysis, and decision-making to policy formulation, implementation, supervision, evaluation, and risk management. These strategies and policies are then incorporated into the Company’s Work Plan and Budget (RKAP), serving as guidelines and focus areas for business activities throughout the fiscal year.

In formulating strategies and policies, the Board of Directors consistently considers the Company’s vision, mission, and both short-term and long-term targets. The Board also takes into account potential risks, the Company’s performance, issues that may affect business continuity, recommendations from the Board of Commissioners, shareholder directives, and other relevant factors.

To ensure the successful implementation of these strategies, the Board of Directors conducts evaluations to assess their effectiveness through Board of Directors meetings with relevant Division Heads, as well as regular internal reporting mechanisms. This approach ensures that the strategies adopted by the Company are appropriate, efficient, and effective in achieving the set objectives while also enabling the Company to navigate market dynamics and economic challenges.

Analysis of the Company’s Performance in 2024

Amid the challenging and uncertain conditions in 2024, the Company managed to achieve better performance than the previous year. Although not all targets were met, the Company’s overall operational and financial performance recorded a fairly positive achievement compared to 2023.

Operationally, AirAsia recorded a total of 6.61 million passengers, an increase of 6.91% compared to 6.18 million passengers in 2023. The Company’s seat capacity also grew by 4.33%, from 7,273,620 seats in 2023 to 7,588,260 seats in 2024.

In 2024, AirAsia’s ASK was recorded at 11,142 miles, up 7.78% from 10,338 miles in the previous year. The Company’s RPK also increased by 9.71%, from 8,783 miles in 2023 to 9,636 miles in 2024.

The Company’s load factor was recorded at 87% in 2024, an increase of 2.47% from the previous year’s 85%. The Company also achieved an average On-Time Performance (OTP) of 83% in 2024, improving from 73% in the previous year. Based on this performance, research by Cirium recorded that AirAsia achieved an on-time departure rate of 78.97%, placing AirAsia in eighth position as the most punctual low-cost airlines in the world.

Financially, the Company recorded revenue of Rp7.94 trillion in 2024, an increase of 19.90% from Rp6.63 trillion in 2023. The Company also managed to reduce operating losses by 1.91%, from Rp805.76 billion in 2023 to Rp790.39 billion in 2024. Despite these positive operational trends, the Company recorded a loss of Rp1.53 trillion, primarily driven by the weakening of the rupiah against the US dollar compared to 2023. However, excluding the impact of exchange rate fluctuations, operational results actually showed a 23% improvement in profitability compared to 2023. Meanwhile, the rupiah exchange rate against the US dollar in 2024 has weakened by 5%, from Rp15,219 to Rp15,906 per US dollar. This depreciation had a negative impact, contributing to an exchange rate loss of Rp580 billion, accounting for approximately 38% of the total loss.

AirAsia’s commitment to delivering high-quality service was once again recognized on a global scale. This year, AirAsia was awarded the World’s Best Low-Cost Airline 2024 by Skytrax, maintaining its reputation as the world’s best low-cost carrier. This achievement reflects the Company’s consistency in providing a comfortable, affordable travel experience that meets customer expectations.

Challenges Faced and Efforts to Resolve Them

2024 remained a challenging year for the Company’s business performance. We recognize that external factors, particularly the high cost of fuel, continue to be one of the biggest challenges in the aviation industry. The fluctuation in oil prices throughout 2024 impacted the Company’s operational costs, as aircraft fuel expenses contribute the most to the cost of production. Additionally, exchange rate fluctuations were another factor influencing the Company’s operational decisions.

We view oil price and currency exchange rate volatility as common business and operational dynamics in the aviation industry. These conditions are also a key consideration for the Board of Directors in formulating the Company’s business strategy and plans each year. Therefore, the Company continuously strives to balance oil price volatility by improving operational efficiency, although this remains highly dependent on the extent of price fluctuations. Nevertheless, the Company has implemented mitigation measures aimed at balancing the impact of such volatility, as successfully done in previous years.

The general elections held in various countries in 2024, including Indonesia, also impacted the Company’s business activities. Changes in government leadership influenced policy shifts, including in the aviation industry. This was reflected in investors’ and the public’s decision to adopt a wait-and-see approach, which slowed down business growth across industries, including aviation.

In response to these conditions, as a responsible corporate citizen, AirAsia continues to fully support government policies. The Company believes that government policies are aimed at stimulating consumer interest in travel, thereby creating new opportunities and driving demand for the Company.

Internally, the Company also faced challenges related to aircraft reactivation to meet increasing market demand. We view this initiative as an important strategy to optimize the use of existing aircraft and support the Company’s operational performance.

To expand operational reach and enhance performance, the Company has implemented a route management strategy by opening new, highly profitable routes while reducing frequency or discontinuing routes with low profitability or financial losses. This approach was taken to optimize the Company’s resources, ensuring that AirAsia delivers the best service in alignment with its business performance improvement efforts.

To effectively address all challenges, the Board of Directors consistently evaluates the strategies implemented. This evaluation ensures that the Company’s strategies remain relevant to current conditions and contribute to performance improvements. Therefore, the Board of Directors is committed to maintaining an optimal corporate performance by upholding the right strategies while continuously refining and innovating them.

Business Outlook

Entering 2025, AirAsia remains optimistic and views business opportunities positively, particularly in Indonesia. According to IATA, global passenger numbers are projected to exceed five billion in 2025, with total flights reaching 40 million. However, the Company acknowledges that the increase in air travel demand post-pandemic has not been matched by the number of operating aircraft, with Indonesia currently experiencing a significantly lower fleet count compared to previous periods. This situation presents both an opportunity and a responsibility for the Company, which conducts its aviation business through its subsidiaries, to contribute and provide solutions to this challenge.

AirAsia consistently strives to ensure that its fleet is swiftly operational and meets expectations in delivering quality assurance, both in terms of service and compliance with applicable standards. Given that Indonesia is an archipelagic country with a large population, the Company recognizes the vast market potential.

Considering that the number of available aircraft remains lower than pre-pandemic levels, the Company believes that opportunities for growth and expansion are increasingly wide open. To seize these opportunities, the Company has formulated strategies and targets to provide the best service for its customers. In line with AirAsia’s position as the airline with the largest international market share in Indonesia, AirAsia aims to launch new routes to expand its market reach beyond the core ASEAN region, with a focus on India and Australia.

Going forward, AirAsia will also centralize fleet operations in Bali to strengthen its market presence in Hong Kong, India, and Australia. To enhance global connectivity, AirAsia plans to further develop its Fly-Thru service for international passengers. Additionally, to maintain strong domestic route performance, AirAsia will expand routes with high profitability potential.

Implementation of Corporate Governance

AirAsia remains committed to strengthening corporate governance implementation across all operational aspects. We are dedicated to ensuring that all Company policies and operations comply with applicable laws and regulations, including capital market regulations, by adhering to corporate governance principles.

The Company considers corporate governance as a fundamental pillar in establishing AirAsia as an entity with a robust governance system, supporting optimal performance achievement and enhancing its credibility as a trusted company. To ensure the realization of these objectives, the Company has implemented various policies to support corporate governance execution and enforcement.

In 2024, the Company comprehensively enforced its anti-bribery and anti-corruption policy to ensure that employees, the Board of Directors, and the Board of Commissioners uphold high standards of integrity and business ethics. Additionally, the Company implemented a whistleblowing system (WBS) as a reporting channel for suspected violations committed by employees, the Board of Directors, or the Board of Commissioners.

The Board of Directors assesses that the implementation of the WBS within the Company has been effective. In practice, the Company has designated the Internal Audit Unit and the Regional Fraud and Investigation Team as responsible parties for receiving and handling reports of Code of Conduct violations. Throughout 2024, the Company did not receive any violation reports via the WBS reporting channel.

The Company has also integrated its internal control system and risk management framework. This implementation aims to support the achievement of the Company’s objectives, vision, mission, and performance targets in conducting its business activities.

Furthermore, as part of its commitment to maintaining aviation safety standards, AirAsia consistently undergoes the Operational Safety Audit (IOSA) conducted by the International Air Transport Association (IATA). This operational safety audit covers various airline operational and functional areas, including but not limited to organization and management systems, flight operations, operational control and flight dispatch, aircraft maintenance and technical operations, cabin operations, ground handling operations, cargo operations, and safety and security management.

Going forward, the Company will continue to strengthen corporate governance implementation by adapting policies to industry dynamics. By doing so, the Company ensures that all business activities are conducted responsibly and in full compliance with applicable regulations, enabling AirAsia to deliver the best services to its stakeholders.

Commitment of the Company to Achieving Sustainability Performance

To achieve its established vision and mission, the Company continuously integrates sustainability principles into all its operational activities. The Company recognizes that implementing a sustainability strategy is not merely about regulatory compliance but also a proactive step in creating long-term value for stakeholders while generating positive impacts on the environment and society.

To ensure the realization of these objectives, the Company launched the Sustainability Redbook in 2023. The Sustainability Redbook serves as a guideline for achieving its vision of becoming a company that embraces sustainable business practices and strengthens its competitive advantage by 2025. In general, the Sustainability Redbook outlines the pillars that the Company uses to achieve these objectives: economic, environmental, and social pillars. These pillars align with the Company’s efforts to support the achievement of the Sustainable Development Goals (SDGs), particularly in the following 8 (eight) key goals, namely:

- Goal 5: Gender Equality;

- Goal 8: Decent Work and Economic Growth;

- Goal 9: Industry, Innovation, and Infrastructure;

- Goal 11: Sustainable Cities and Communities;

- Goal 12: Responsible Consumption and Production;

- Goal 13: Climate Action;

- Goal 16: Peace, Justice, and Strong Institutions; and

- Goal 17: Partnerships for the Goals.

The Company demonstrates its commitment to achieving the SDGs by implementing various corporate social responsibility (CSR) initiatives and reinforcing sustainability values among Allstars. The Company consistently internalizes sustainability values through training, awareness programs, and system implementation for employees, covering various themes, including:

- Supporting the acceleration of the Company’s economy by implementing corporate governance principles, sustainable supply chains, and human rights;

- Driving digital transformation through guest experience acceleration, technology & innovation, and information security & data privacy;

- Promoting environmental sustainability through climate strategy and waste management practices;

- Ensuring employee and consumer safety through the implementation of operational safety, occupational health and safety, and food safety measures;

- Enhancing employee well-being by upholding diversity & inclusion values and talent attraction & retention; and

- Fostering regional collaboration by supporting ASEAN Community.

Policies to Respond to Challenges in Fulfilling Sustainability Strategy

The Company recognizes that achieving a sustainable future comes with its own set of challenges. Therefore, the implementation of effective risk management is believed to be essential in minimizing these challenges, particularly those related to sustainability. Based on the identification process, the Company faces challenges stemming from three key aspects: operational, regulatory, and commercial.

From an operational aspect, the Company is challenged with reducing its carbon footprint through fuel efficiency and optimizing operational performance. In reducing carbon footprint, the Company requires innovation and significant investment, while optimizing flight routes and implementing environmentally friendly aircraft maintenance also entail substantial costs.

From a regulatory aspect, one of the main sustainability challenges is the absence of formal regulations on carbon emission reduction in Indonesia. This lack of regulatory guidelines makes it difficult for the Company to establish formal operational frameworks for emission reduction, despite AirAsia’s ongoing efforts to voluntarily align with global best practices.

From a commercial aspect, the main challenge is the implementation of a carbon offsetting program, which could lead to increased ticket prices, potentially affecting consumer demand. Although public awareness of sustainability has improved in recent years, the sensitivity of Indonesian consumers to high airfare prices remains a key consideration. As a result, the Company needs a strategic approach to balance sustainability performance with consumer expectations.

To address these challenges, the Company has developed policies and implemented strategic measures to maximize its sustainability efforts. One of these measures includes signing a Memorandum of Understanding with Airbus in 2024 to explore the production of sustainable aviation fuel (SAF). This initiative aims to identify potential projects that could expand SAF supply within the ASEAN region.

AirAsia has also broadened its stakeholder engagement strategy beyond internal policymakers and decision-makers to include greater involvement from investors and the wider public. This initiative is intended to raise awareness among travelers about their role in mitigating the environmental impact of air travel.

Additionally, the Company collaborates with various institutions in the tourism sector, both in Indonesia and partner countries, to promote local and international destinations. This includes launching special aircraft liveries, marketing collaborations, sales missions, and other initiatives designed to support sustainable tourism and stimulate local economic growth.

Performance Achievement of Sustainability Strategy

The Company is committed to comprehensively implementing operational sustainability principles across all aspects of its operations. This approach ensures that the Company’s business activities not only contribute to AirAsia’s growth but also create positive economic, environmental, and social impacts while supporting the achievement of the SDGs in Indonesia. The Company’s sustainability performance based on economic, environmental, and social pillars is outlined as follows:

-

Economic Performance

As the best low-cost airline according to Skytrax, AirAsia remains committed to driving sustainable business growth. To achieve this, the Company continues to expand its flight network by opening new domestic and international routes. This expansion aims to attract tourists and contribute to local economic growth through the tourism sector.

The Company consistently improves service quality, provides various supporting facilities, and offers compensation in cases of flight schedule delays. Additionally, the Company conducted a customer satisfaction survey, which resulted in a satisfaction score of 88% with the category of “Good”. -

Environmental Performance

In 2024, the Company carried out a CSR initiative by planting 5,000 mangrove seedlings in collaboration with Yayasan ITB74 and the Kelompok Tani Hutan (KTH) Cipta Pesona in Cilamaya, Karawang Regency, West Java. This initiative supports nature conservation efforts and raises community awareness of the importance of coastal ecosystem sustainability. It also serves as part of the Company’s carbon emission reduction efforts and aligns with SDG Goal 13 (Climate Action) and Goal 17 (Partnerships for the Goals).

Additionally, the Company provides environmentally friendly inflight catering services. This initiative includes the use of biodegradable packaging by Santan, AirAsia’s inflight catering provider, to reduce single-use plastic waste. Pre-flight meal orders can also be made via the AirAsia MOVE app to minimize food waste. This effort aligns with SDG Goal 12 (Responsible Consumption and Production). -

Social Performance

AirAsia is committed to making a positive impact on both the community and its employees. In addition to providing high-quality flight services to consumers, the Company strives to create a fair and safe working environment by implementing diversity, equality, and inclusivity (DEI) in employment practices.

To promote equal employment opportunities, in 2024, AirAsia recruited 66 new employees, comprising 44 men and 22 women. Additionally, the Company recorded a female pilot representation of 12%, while male pilots made up 88%. This significant female pilot presence ranks AirAsia as the ninth airline globally with the highest percentage of female pilots. This achievement aligns with SDG Goal 5 (Gender Equality) and Goal 8 (Decent Work and Economic Growth).

The Board of Directors believes that the aviation industry’s recovery momentum presents a strong opportunity to enhance sustainability performance. This optimism is supported by improved operational performance, with AirAsia’s passenger numbers increasing by 6.91% compared to 2023.

From a financial perspective, the Company’s revenue in 2024 increased by 19.90% compared to the previous year. Internal factors contributing to this revenue growth include the operation of 24 Airbus A320 aircraft and the launch of seven new routes in 2024. Externally, the recovery of the global aviation industry has driven a 10.4% increase in seat demand throughout 2024 compared to 2023. The Board of Directors remains optimistic that this growth will continue sustainably into 2025.

In terms of environmental impact, the Company recorded a 5.71% reduction in water usage, a 0.95% reduction in electricity consumption, and an 8.60% reduction in emissions at the AirAsia Redhouse building compared to 2023.

The Board of Directors is committed to further enhancing the positive sustainability performance achieved to date. Through these efforts, AirAsia aims to ensure that its business activities continue to contribute to a sustainable future, benefiting both the environment and society for generations to come.

Changes in the Composition of the Board of Directors

Throughout 2024, the composition of the Company’s Board of Directors underwent changes. Based on the resolution of the Extraordinary General Meeting of Shareholders (GMS) on August 20, 2024, the shareholders approved the resignation of Mr. Jurry Soeryo Wiharko and appointed Mrs. Luh Gede Mega Putri Tjatera as Director. The composition of the Board of Directors in 2024 is as follows:

Period of January 1 - August 20, 2024

| Name | Position | Basis for Appointment | Term of Office |

|---|---|---|---|

| Veranita Yosephine Sinaga | President Director | AGMS July 6, 2022 | July 6, 2022 - July 5, 2027 |

| Jurry Soeryo Wiharko | Director | EGMS November 16, 2023 | November 16, 2023 – November 15, 2028 |

Period of August 20, 2024 - December 31, 2024

| Name | Position | Basis for Appointment | Term of Office |

|---|---|---|---|

| Veranita Yosephine Sinaga | President Director | AGMS July 6, 2022 | July 6, 2022 - July 5, 2027 |

| Luh Gede Mega Putri Tjatera | Director | EGMS August 20, 2024 | August 20, 2024 – August 19, 2029 |

Appreciation and Closing

We believe that AirAsia’s success in maintaining strong performance in 2024 would not have been possible without the support and contributions of all parties. Therefore, we would like to express our gratitude to the shareholders and the Board of Commissioners for their cooperation, advice, and recommendations. We also extend our appreciation to all management members and Allstars, whose dedication and strong commitment have enabled the Company to sustain solid performance amid challenges.

The Board of Directors also wishes to thank all passengers, business partners, regulators, and other stakeholders for their trust and collaboration with AirAsia. We remain optimistic that the continuous improvements taking place, supported by strong synergy between shareholders, Allstars, and stakeholders, will enable AirAsia to continue growing and developing in the future.

Tangerang, 28 April 2025

On Behalf of the Board of Directors

Veranita Yosephine Sinaga

President Director